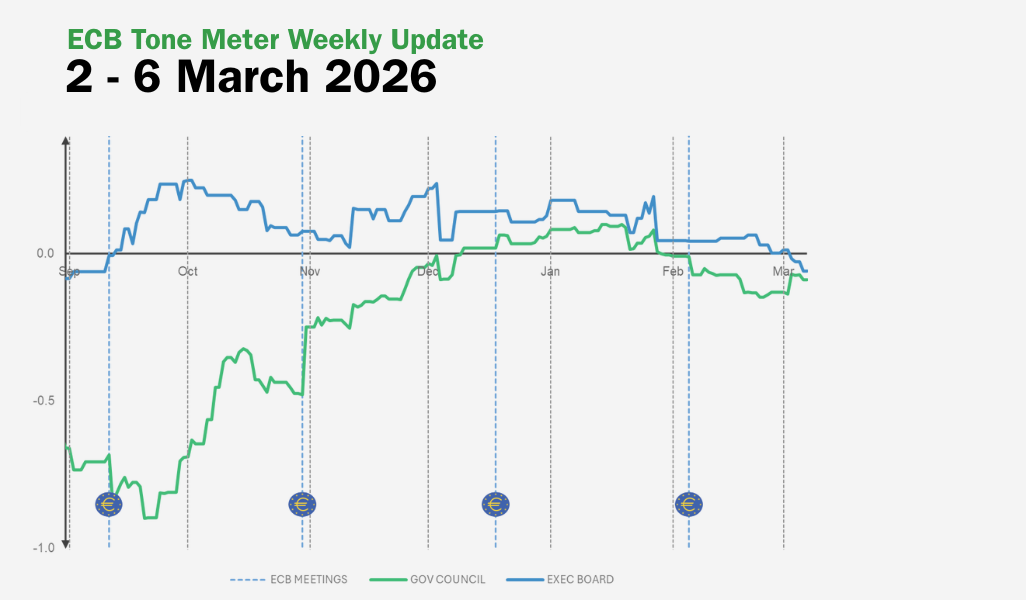

ECB Tone Meter Weekly Update: Iran Conflict Leaves Entire Council Less Dovish, but Board Tilts More Dovish

By Marta Vilar – MADRID (Econostream) – Econostream’s ECB Tone Meter showed the Governing Council becoming less dovish this week, while the Executive Board moved back into slightly dovish territory.

7 March 2026