ECB Should Step Up Quantitative Tightening Pace, Nagel Says

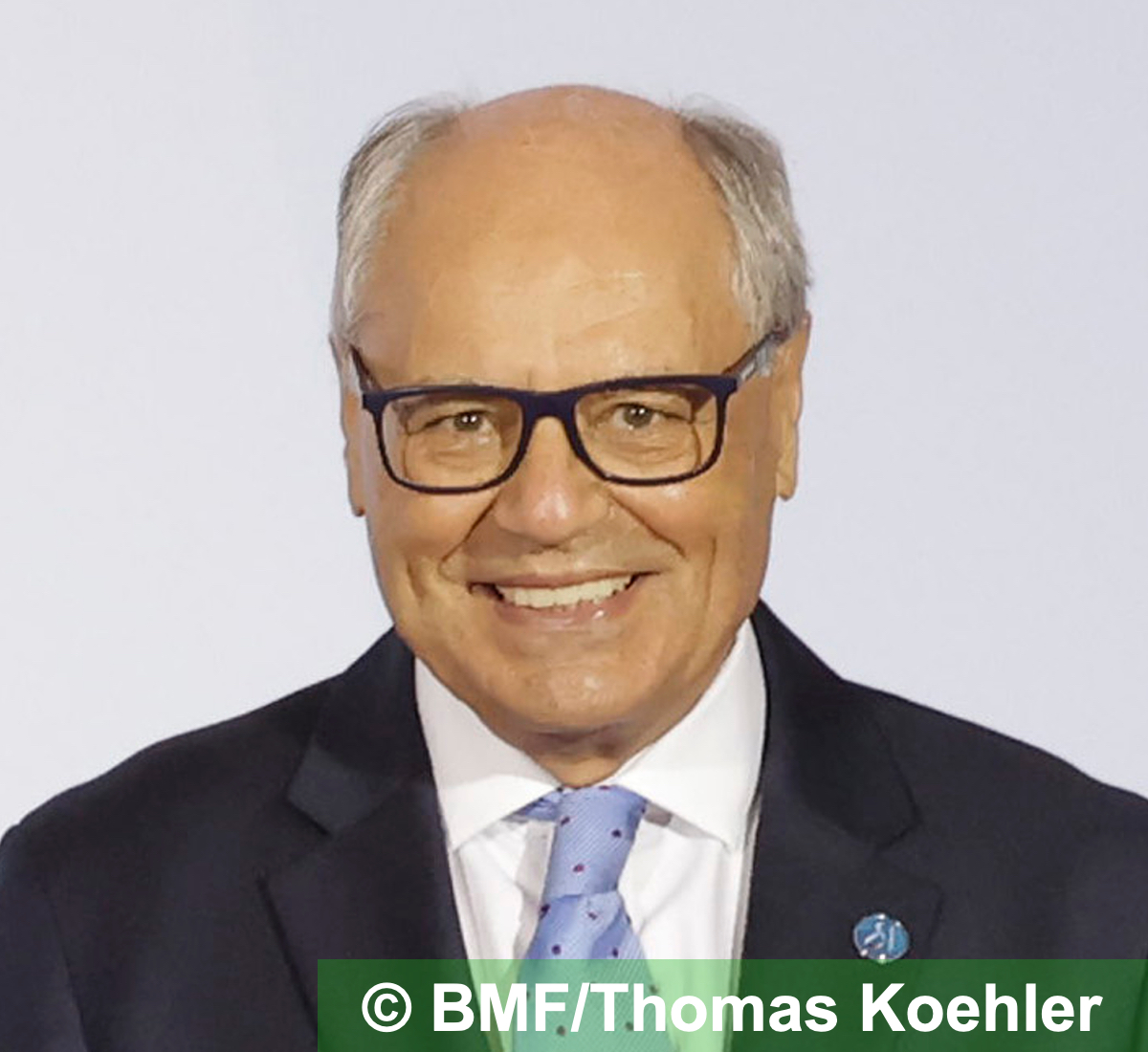

By Xavier D’Arcy – FRANKFURT (Econostream) – European Central Bank Governing Council member Joachim Nagel said on Monday that it was necessary to reduce the ECB’s bond holdings more quickly.

27 March 2023