ECB’s Stournaras: If Outlook Continues to Weaken, We’ll Consider Cutting

5 November 2025

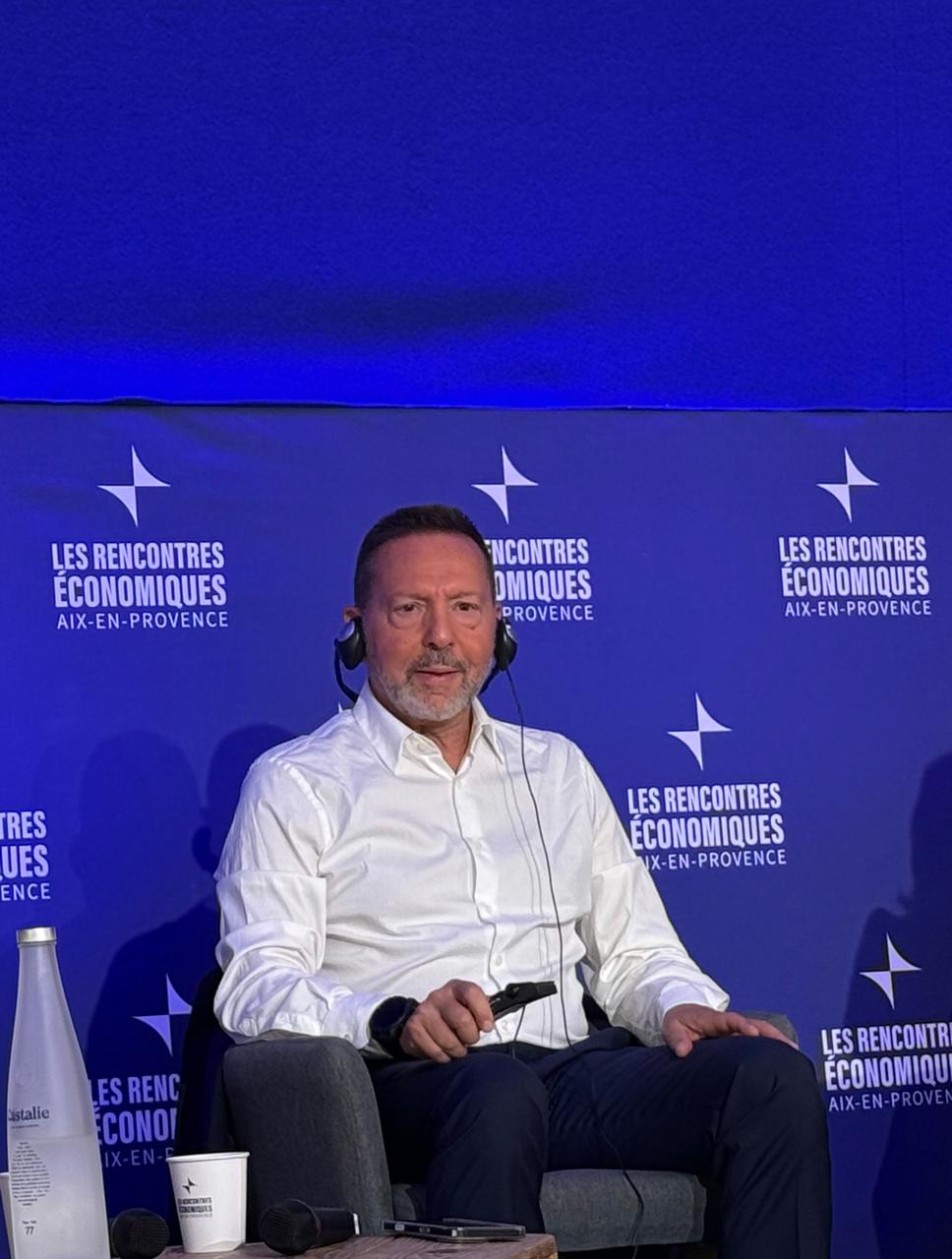

By David Barwick – FRANKFURT (Econostream) – European Central Bank Governing Council member Yannis Stournaras on Tuesday said that monetary authorities would entertain further easing if the outlook weakened further.

In an interview with MNI released Wednesday by the Bank of Greece, which he heads, Stournaras said, “You will see most of the arguments are in favor of inflation and growth becoming lower but despite that we don't jump to the conclusion that we should cut in the next meeting.”

“So we are at equilibrium,” he was quoted as saying. “So why should we reduce interest rates? This is one question. If it continues to become weaker, okay, then we will consider it.”

However, he showed little interest in a so-called insurance cut. “If one cut makes no difference, why should I do it?” he said, according to the news agency.

Although risks generally pointed down, there were some upside risks, he said. Indeed, he warned, a further increase of US inflation could boost global import prices. “In fact, the higher longer-term yields may be signaling such risk,” he said.

Stournaras sidestepped the question of how much inflation undershooting it would take to get the ECB to cut rates again, but downplayed the potential impact of a change to the implementation of ETS2.

The ECB would in any case “take everything into account,” he said. “Not only models, but also data from other sources, energy for instance. And judgment, at the end it's judgment.”