ECB’s Stournaras: Euro Area Resilient but Faces Structural Weaknesses, Political Risks

4 November 2025

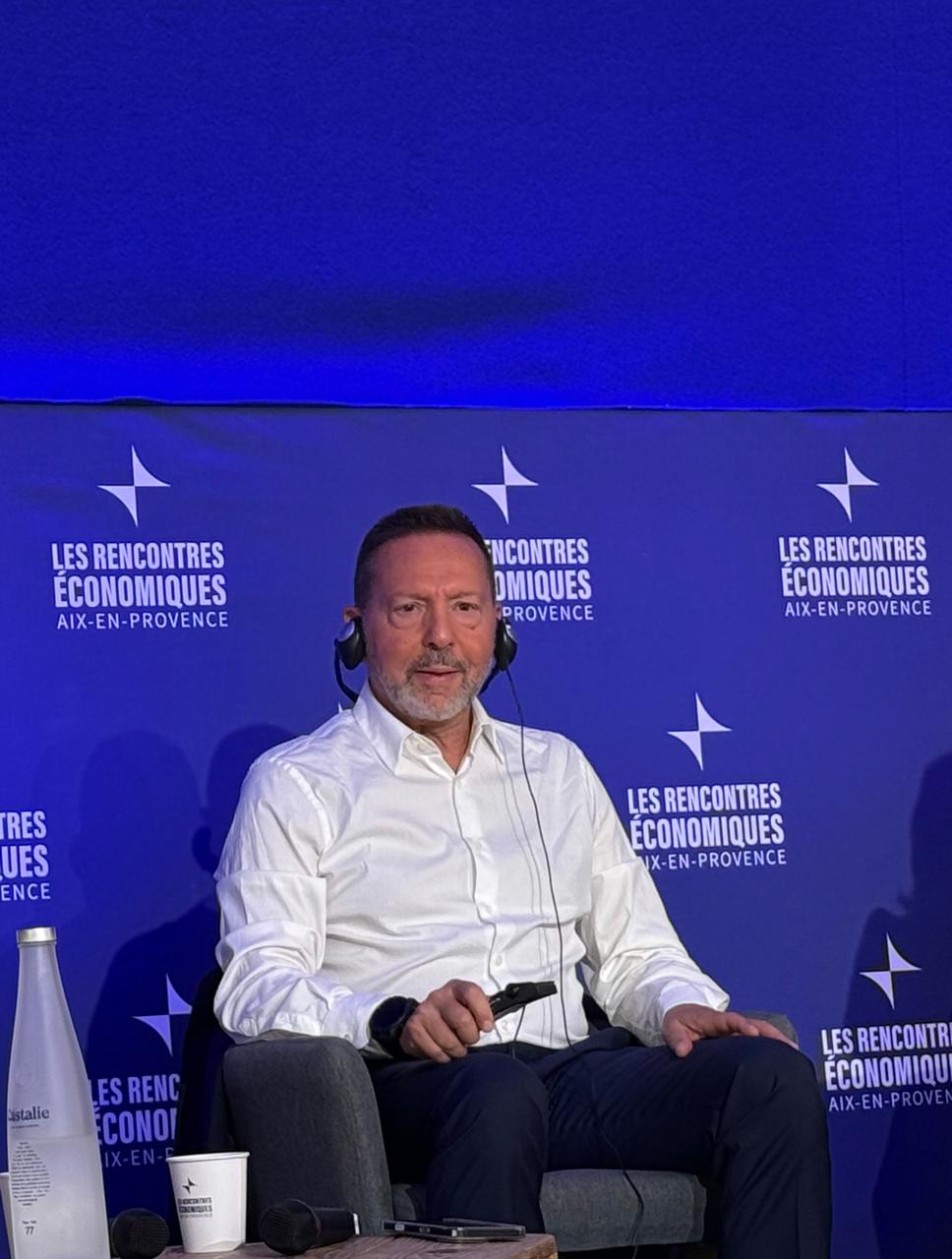

By David Barwick – FRANKFURT (Econostream) – European Central Bank Governing Council member Yannis Stournaras on Tuesday said the euro area economy had shown remarkable resilience despite a volatile global environment, but warned that long-standing structural shortcomings and heightened geopolitical and political risks continued to weigh on growth prospects.

Stournaras, who heads the Bank of Greece, told a conference in Athens that the July trade agreement between the United States and the European Union imposing a 15% ceiling on US tariffs for European exports was a “difficult but necessary compromise.”

The accord, he said, should help reduce uncertainty by ensuring the continuity and expansion of transatlantic cooperation, even as it disadvantages European producers and obliges the EU to import US energy and invest in US strategic sectors.

According to the latest ECB projections, he noted, euro area GDP growth is expected at 1.2% in 2025 and 1% in 2026, with private consumption and investment as the main drivers, while inflation is forecast to fall from 2.4% this year to 2.1% in 2025 and 1.7% in 2026, supported by lower energy prices, a stronger euro and monetary easing.

He cautioned that euro area growth prospects remain subject to “multiple downside risks”, citing persistent geopolitical tensions, trade uncertainty and political developments in France.

The euro area’s structural weaknesses, above all the gap between monetary and economic integration and the fragmentation of key markets, continue to hold back growth, he said.

Still, Stournaras said Europe also faced an opportunity as investors increased their holdings of European sovereign and high-rated corporate securities, positioning the euro area as a “stable and safe haven for investment” and strengthening the euro’s international role.

To capitalise on this, he urged renewed progress on completing the Banking Union, creating a fully functioning Capital Markets Union as part of the broader Savings and Investment Union strategy, dismantling the remaining barriers to intra-EU trade, and boosting investment in technology, defence and green growth.