Markets Pricing in Rate Cuts; Speculation of Coordinated Action

2 March 2020

Market speculation is increasing about not only central bank easing in reaction the coronavirus outbreak but even emergency meetings to take place before the next round of scheduled meetings and possible coordination of action. According to ECB’s Villeroy there will be a teleconference by the G7. It’s worth noting that co-ordination is a rare occurrence. But the last time there was G-7 FX co-ordination was March 2011 to effectively stem JPY appreciation after the Japan earthquake and tsunami. Notable interest rate co-ordination was last made in October 2008 in the wake of the Lehman collapse and financial market crash.

The Bank of England has this morning said it is working with the Treasury and international partners “to ensure all necessary steps are taken to protect financial and monetary stability”.

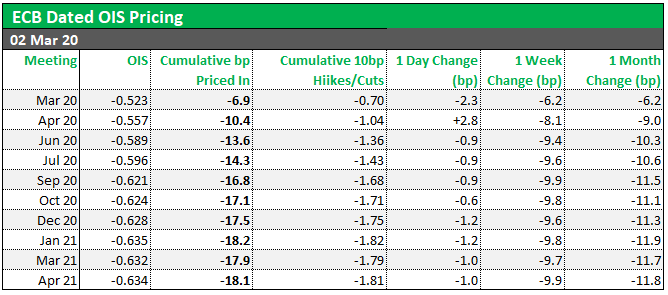

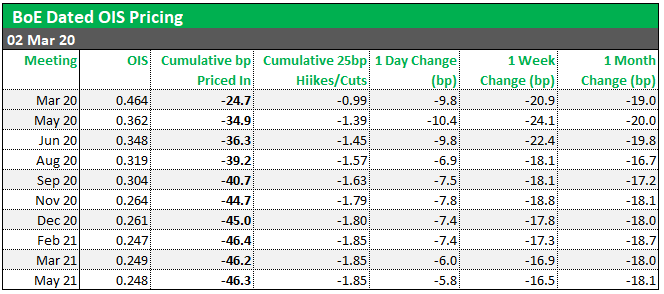

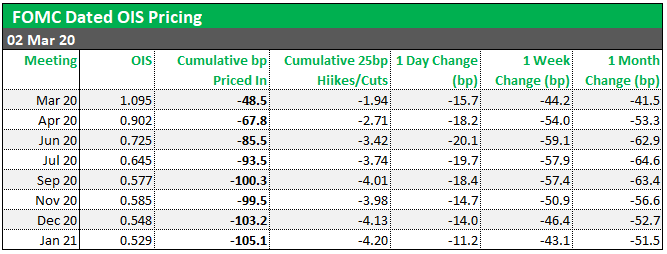

This speculation has led to some dramatic moves in the market pricing of action from the major central banks. OIS markets are now pricing in almost 50bp of cuts by the March meeting and 100bp of cuts by September. For the Bank of England the market is fully priced for a 25bp cut in March and total 45bp by year end. Even the ECB is now expected to cut it’s deposit rate by 6bp this month and 11bp by year end.

]]>

]]>