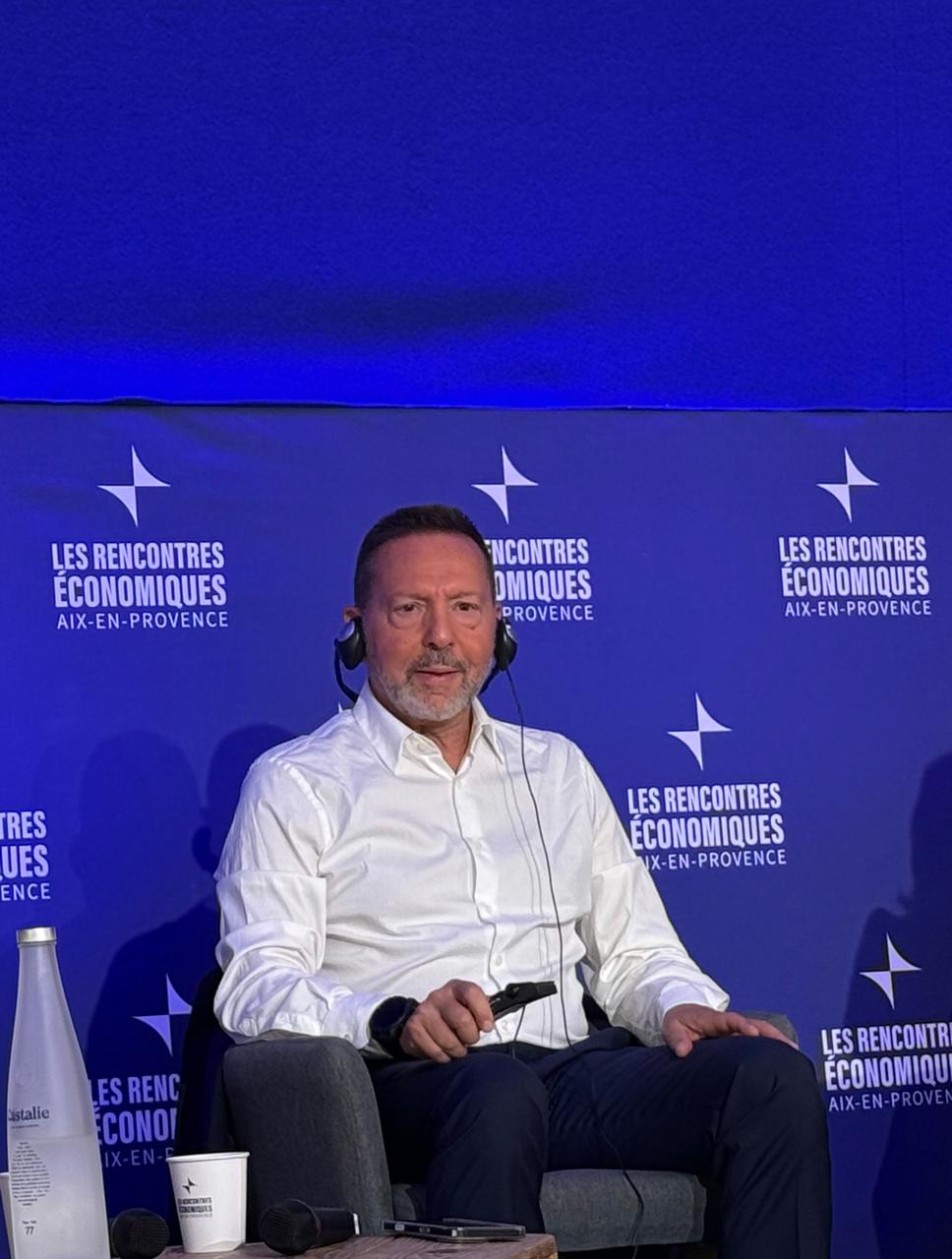

By David Barwick – FRANKFURT (Econostream) – European Central Bank Governing Council member Yannis Stournaras on Saturday said that monetary policy restrictiveness had been mostly removed.

In a speech at Les Rencontres Économiques in Aix-en-Provence, France, Stournaras, who heads the Bank of Greece, said, ‘Over the past year, as inflation has eased, we have been able to largely remove policy restrictiveness.’

‘This easing in financing conditions will make capital more affordable and accessible, which is essential for investment in a time of very high uncertainty’, he said.

Stournaras called for a genuine Savings and Investment Union as a means of better directing savings into investment that would ultimately raise potential growth.

‘A more integrated union will allow the euro to take on a greater role as an international currency’, he said.

‘Europe must rise to the occasion’, he said, noting that a digital euro ‘can increase efficiency, innovation and resilience while protecting our monetary sovereignty.’

The lack of a central fiscal instance corresponding to the monetary authority was holding Europe back, he said.

‘A permanent central fiscal capacity – a shared framework for managing public finances – would be a true turning point, enabling coordinated investment and shared responsibility for growth-enhancing initiatives’, he said.

The Recovery and Resilience Facility (RRF) could point the way, he said. A common safe asset would facilitate European financial integration and resilience, he said.

Moreover, getting rid of internal barriers that effectively acted as tariffs would enhance the profitability of domestic investment in line with the Draghi Report, reducing the investment and productivity gap between Europe and the US, he said.

‘More ambitious proposals, such as the one recently put forward by Olivier Blanchard and Ángel Ubide, deserve consideration: they could help create a deep and liquid EU bond market that could achieve greater global significance’, he said.