ECB Market View? Back to Cutting?

11 February 2020

11th February 2020

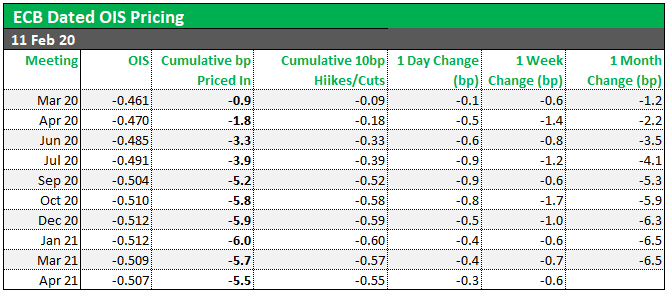

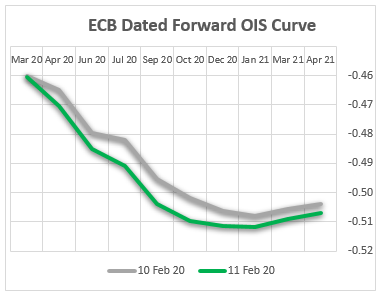

Investors are increasingly seeing more likelihood of the ECB cutting rates again this year due to ongoing concerns around the spread of coronavirus. Markets had two “sources” stories to digest today. The first, from Reuters, saw only limited market impact – a technical look at the ECB’s treatment of house prices in inflation data, the article suggests that the ECB would not tackle this directly in their strategic review but would rather ask the European stats office to find a fix. The second article, from MNI, reportedly suggested that chances are rising of an ECB rate cut on the back of weak data and coronavirus concerns. This was followed by headlines regarding the difficulty of fighting coronavirus in rural area of China and triggered a bid in the short end of the European curve.

By the end of the day, markets were pricing in approx. 10% more chance of a 10bp deposit rate cut by July 2020 than yesterday, and earlier in the day a further 10% chance had been priced in before the market eased back off its peak levels. Overall the market is now pricing in 6bp of cuts this year, or 60% chance of a 10bp deposit rate cut, by the end of the year – just one month ago, the market was pricing in no change at all.

The table and graphs show what the financial markets anticipate (or are “pricing in”) for future interest rate policy from the ECB and how this has changed over recent days and weeks. This provides a great barometer of how the markets are interpreting the impact of recent news, speeches, data and events on the outlook for monetary policy.

To create the table we analyse the OIS markets (see details below). The table shows, for each future ECB meeting: the level of the OIS market, how much that implies the ECB deposit rate will move up or down from current levels by the time of that meeting (in basis points) and how many hikes or cuts that is equivalent to. The table also details how much these expectations have changed over the last day, week and month.

If, for example, the table shows the ECB will lower the deposit rate 5bp by the December meeting (ie half a 10bp cut), this implies the market thinks there is a 50% chance of an interest rate cut at, or before, the December meeting.

Interpreting the Data

There are a few different ways to determine what the market expects for future interest rates moves by central banks. All involve analysing short term interest rate markets and the options vary a little by country. We generally prefer using the OIS (overnight indexed swap) market - specifically the OIS swap dated to a specific central bank meeting. The dates on these swap contracts exactly match the central bank policy implementation dates allowing for an accurate reading. The difference between the interest rates implied by these OIS contracts and the actual current overnight interest rate can be interpreted as the expectations for the direction and magnitude for that central bank’s future interest rate policy change. For the ECB we use ECB Dated OIS contracts.