What Is the Market Expecting for the BoE Rate Path? (OIS Market Analysis)

11 May 2017

EconoStream’s analysis of the OIS markets to determine how market participants view the likely path of the Bank of England (BoE) base rate. An accurate assessment of these perceptions is key to understanding how the markets in general will react to actual action (or lack of it) by the Bank of England’s MPC.This market view on how the BoE will act in the future is in constant flux as traders receive and digest fresh news and data. Fluctuations may be driven by factors including policy decisions, the BoE meeting minutes, details in the Quarterly Inflation Report, speeches by MPC members, economic data and media stories. Evaluating how the markets react to these events is the best way of determining whether and how the events changed perceptions on the likelihood of BoE action.

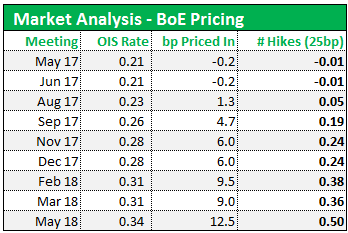

The table below outlines what rate action (if any) is priced at each coming MPC meeting.

Generally speaking, expectations are not high for BoE action over the next few months. This is certainly true for today as we head towards the general election, but is also true for well into next year.

We can see from the table that there is no significant expectation at all for any BoE rate action today or in June. Thereafter though the market is clearly positioned for more chance of a hike than a cut moving forwards. That said, expectations are muted with just a 24% chance of a hike priced in by the end of 2017 and a 50/50 chance of a hike by May 2018, a whole year from now.